After taking out the exemption and standard deduction, the taxable income would be about $13,650 for a tax of about $1,600. If you are single, you should have had about $2,800 in federal taxes taken out of your paycheck for your annual gross income of $24K. How much will I get back in taxes if I made 24000? That’s money that could go to cover what income taxes you owe - or possibly lead to a bigger federal income tax refund. On $10,200 in jobless benefits, we’re talking about $1,020 in federal taxes that would have been withheld.

If you had taxes withheld on jobless benefits, the federal taxes are withheld at a 10% rate. How much taxes do you pay on unemployment? If it’s been longer, find out why your refund may be delayed or may not be the amount you expected. When to Expect Your Refund Refunds are generally issued within 21 days of when you electronically filed your tax return or 42 days of when you filed paper returns.

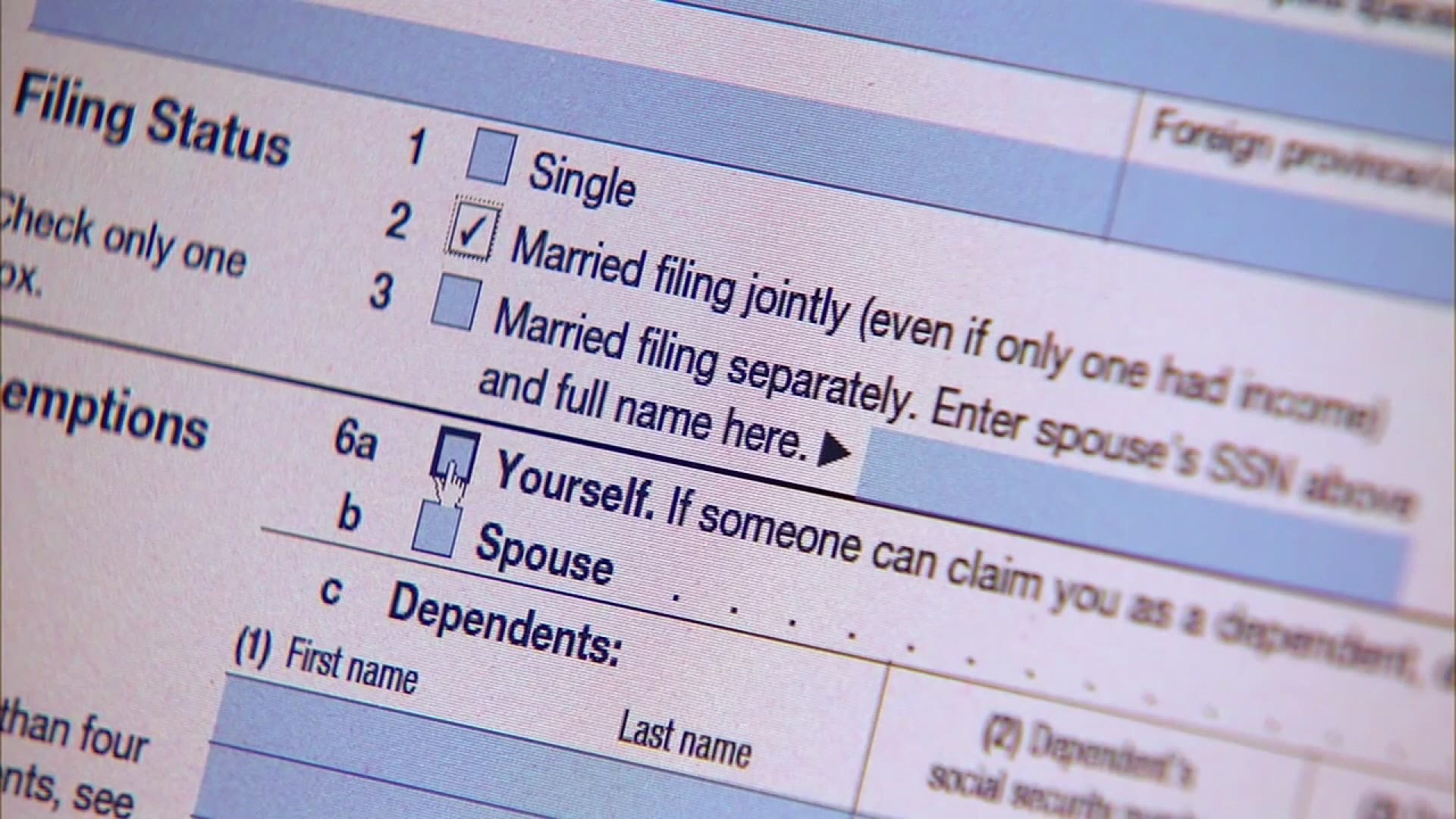

#Unemployment tax break refund how to#

You might be interested: How To Fill Out Self Employment Tax Form? (Correct answer) When should I expect my tax refund? Assuming that the amount withheld for federal income tax was greater than your income tax for the year, you will receive a refund for the difference. Your refund is determined by comparing your total income tax to the amount that was withheld for federal income tax. How do you determine how much money you get back from taxes? These taxpayers are getting a refund because they had already reported their unemployment compensation on their 2020 tax returns before the American Rescue Plan (ARP) was signed into law. You’ll receive your refund by direct deposit if the IRS has your banking information on file, and a paper check if not. How do I know if I get unemployment tax refund? According to the IRS, the average refund is $1,686. How much you will receive depends on how much you paid in taxes on your unemployment income in 2020. The IRS can seize the refund to cover a past-due debt, such as unpaid federal or state taxes and child support. However, not everyone will receive a refund. So far, the refunds have averaged more than $1,600.

The tax agency says it recently sent refunds to another 430,000 people who overpaid taxes on their 2020 unemployment benefits.

0 kommentar(er)

0 kommentar(er)